Although it is difficult to find high-interest best savings accounts, you should still make sure you are maximizing your savings because some institutions provide pathetic rates of just 0.01%.

First Direct now provides a normal saver account with a market-leading interest rate of 3.5 per cent, but you must create a current account to take advantage of the best rate. Below is further information.

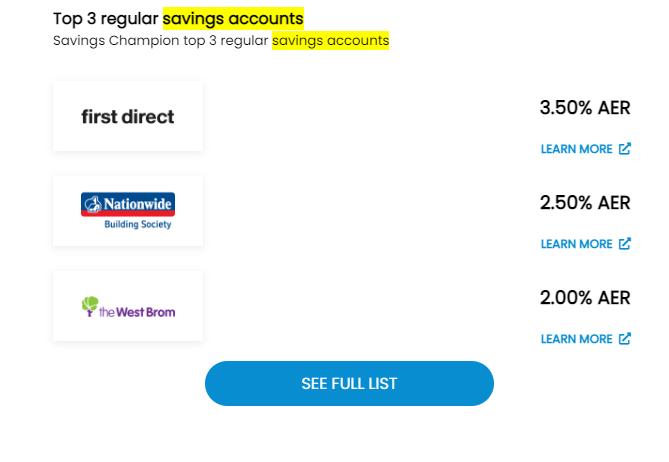

Here’s a short review of the current best savings accounts before we get into these in more detail in this article:

Best Savings Accounts With Quick Access

Savers who have a large amount of money in their bank account that they could need right away.

Why do we rank accounts with simple access?

Simple savings accounts called “instant access savings accounts,” let you make cash withdrawals immediately. Interest rates are frequently lower than those of other types of accounts.

While easy-access accounts are often clear-cut and simple to comprehend, there are still some accounts of each account’s terms and conditions to be aware of.

For instance:

- Some quick access accounts provide welcome incentives, so after an initial period, the rate paid decreases.

- Others will cap the number of withdrawals exempt from penalties that are permitted annually.

People who might need to access their money quickly are forced to store it in an accessible location. However, keep in mind that there are other categories of savings products that are discussed later in this article where you may make substantially more.

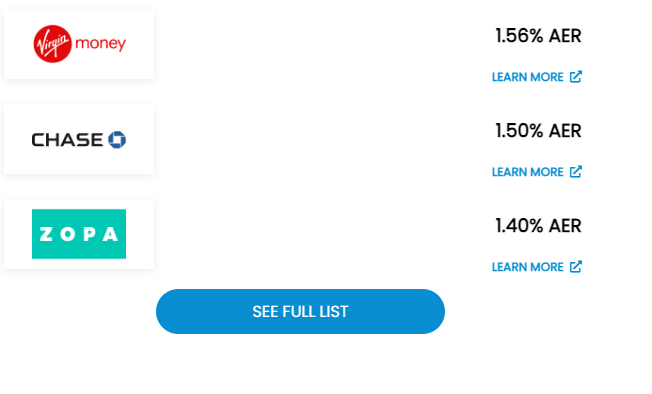

The top three quick access best savings accounts at this time are shown below:

Virgin Money is the highest paying account in the easy-access sector with a savings rate of 1.56%.

Considering a £10,000 down payment:

- With a high-street bank, a rate of 0.01 per cent would yield just £1 in interest during the whole year.

- Although 1.56 per cent isn’t particularly impressive, it does imply that you may make £156 on a £10,000 investment as opposed to £1, putting more money in your pocket than the banks.

Read our post on how to invest $10,000 if you have received a windfall and already have your emergency fund of cash saved up.

The best savings accounts to notice

Best for: Savers who don’t need easy access and can plan ahead.

Why do notice accounts receive a rating?

Notice best savings accounts require you to give notice before withdrawing funds without incurring a fee, as the name implies.

The typical notice duration is between 30 and 120 days. However, certain accounts can require six months or even a year’s notice.

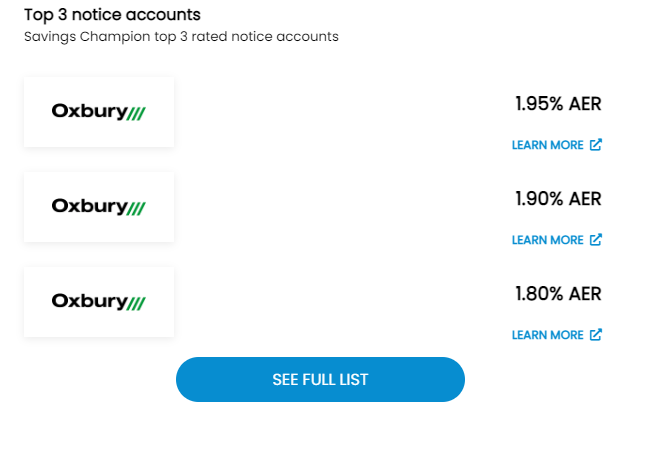

The top three notice best savings accounts at the moment are shown below:

Since none of the major street carriers provides this form of account, notice accounts are somewhat underutilised and less widely recognised.

- A penalty, usually a reduction in interest equal to the notice period, is required in some accounts to waive the notice period.

- It’s crucial to properly prepare since this might be deducted from the money if insufficient interest has accrued before access.

- You should confirm this before establishing an account because not all accounts provide this feature.

You may be able to avoid taking money out of your savings if you can’t access it right away. It could also be a way to earn a little extra interest on funds that you know you won’t need anytime soon.

The best fixed-rate bonds

Best for: Savers who don’t require access to their money but want to be confident of the interest they will earn during the term.

Reasons for rating fixed-rate bonds:

This kind of account is known by a variety of names, most frequently fixed-rate bonds. They are also referred to as fixed-rate savings accounts or fixed-rate deposits.

Fixed-term bonds provide some of the best rates on the market for high-interest best savings accounts. In essence, you are giving up access to your money in exchange for a somewhat higher return.

These accounts offer fixed interest rates for a predetermined period of time, often between six months and five years. There are, however, certain long-term savings bonds that offer up to seven years of stable interest.

Although some companies allow partial access, you usually cannot access your money until the period is over. Before proceeding, be careful to review each account’s terms and conditions.

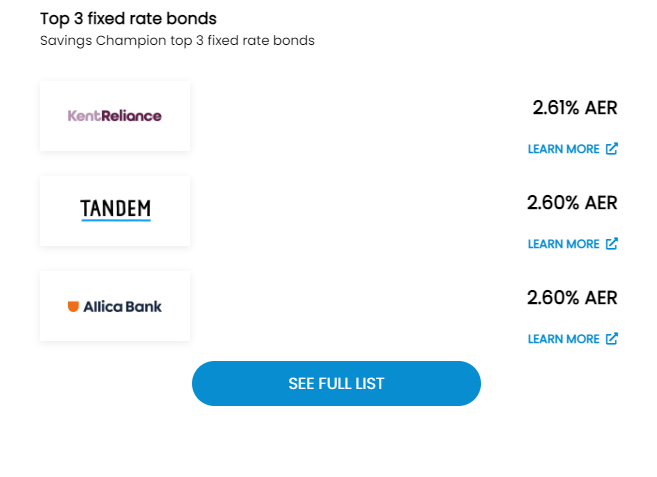

The fixed-rate bonds offering the greatest interest to depositors are listed below.

Nationwide is providing a three-year fixed-rate bond that pays 2.50 per cent if you’re searching for a savings account from a high-street brand but it’s not on the list above. Existing Nationwide customers who hold a current account, savings account, or mortgage are eligible for the promotion.

Although high street banks and building societies compete with Nationwide’s fixed-rate bond, you may get greater rates elsewhere with one-year duration.

Some details on fixed-rate bonds:

- These offers are an excellent approach for banks to attract new clients.

- The best rates, however, don’t last very long because banks frequently withdraw their best offers once they have enough clients on board.

- In order to secure a high rate, you might need to act quickly.

Advice: If you’re willing to commit your money to a long-term savings bond for five years, it could make more sense to invest to increase your chances of receiving a higher return.

Sharia-compliant bonds

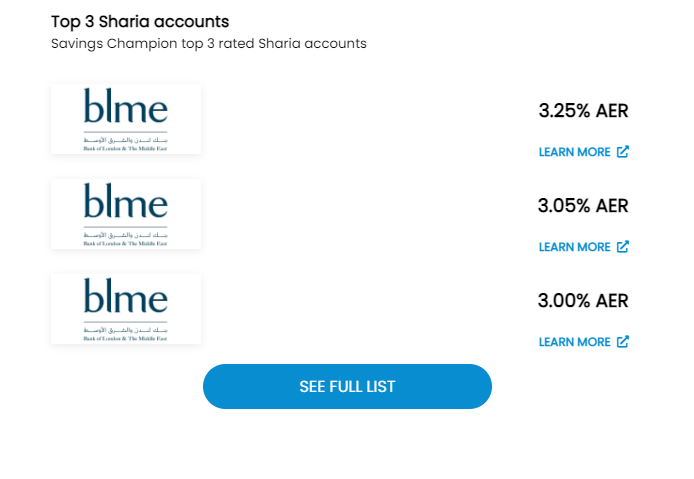

There are also fixed-term bonds that adhere to Sharia law, frequently offering the best yields available. Islamic law is followed via sharia-compliant savings accounts, which are open to all savers.

Sharia law forbids the giving and receiving of interest because it holds that money has no inherent value. These accounts instead pay a projected profit rate (EPR).

Although the EPR is not guaranteed, the rates on fixed-term accounts have always been paid as anticipated, and these accounts have been a part of the savings landscape for some time.

The top three Sharia-compliant fixed-term Best Savings Accounts bonds at this time are listed below:

The Regular Best Savings Accounts

Best for: People who don’t have a lot of money but wish to regularly save money.

Why do we rank conventional savings accounts?

If you don’t have a large sum of money to invest, you may become a regular saver by designating a certain amount of money each month. You have the option of doing this into standard easy access or notice account or using a standard savings account.

Standard Savings Sccounts

- These frequently provide some of the best deals available. However, the amount you can typically put aside for them each month is constrained.

- When you open one, there are terms and restrictions to be aware of.

- The high rates on offer often last for 12 consecutive months as an initial rate before dropping, so you might need to move your money.

- They are often provided to current clients who have bank accounts by banks and building societies.

They are a terrific way to develop a savings habit and accumulate money in an account that pays a respectable rate of interest.

With a rate of 3.5 per cent, First Direct’s ordinary saver account outperforms the competition. To benefit from this top regular saver, you must open a current account with the bank.

What you should know about First Direct’s account is that:

- Up to £300 a month, or $3,600 per year, can be saved.

- Every year, interest is paid.

- At a 3.5 per cent rate, you could earn up to £68 per year.

- To qualify, you must have a current account with First Direct.

- If you’re a new customer, the bank will reimburse you £150 for leaving your present account.

First Direct is not the only company that offers current clients higher interest rates; current account users may also open regular savings accounts with NatWest, RBS, Santander, and Nationwide. Check out the best regular savings accounts that are “linked” for additional details.

If you don’t want to register a new current account, Saffron Building Society has the best regular savings account that is available to everyone. It offers a 2% annual interest rate on deposits up to £50 per month for a year.

These regular savings accounts are the best.

They may become like another bill, but one that you will profit from in the future if you arrange for a direct debit from your bank account on the day after you are paid.

Will rates of savings increase in 2022?

Interest rates on savings accounts have been on the rise since the Bank of England raised the base rate five times in December.

In June 2022, the base rate was raised from 1% to 1.25 %. Since December, when it hit a record low of 0.1 per cent, it has risen four times in a row.

According to Moneyfacts, the easy access market’s average interest rate rose from 0.19 per cent in November of last year to 0.39 per cent in May of 2022.

Read this post if you’re interested in learning when interest rates may increase once more and how it will affect your personal budget.

Although this is terrible news for borrowers, it may result in an increase in the interest that savers may receive on their savings accounts.

However, banks don’t often pass along the whole rate hike to savers, so the difference will be negligible (and don’t anticipate the rate on your savings account to increase immediately either).

If your savings aren’t performing well, it’s worth keeping an eye on the highest-paying accounts mentioned above so you may move to a better bargain.

How to maximize the interest you get on your savings?

Even if savings rates do increase, they won’t come close to outpacing inflation, so it’s still crucial to monitor your savings.

- Compare offers to find the best savings accounts.

- When your current rate expires, move your money to a better rate.

- Make sure the Financial Services Compensation Scheme is protecting your money.

- Make sure the Financial Conduct Authority has approved and regulated your supplier.

- Consider the many types of savings accounts that are offered.

The greatest interest rates are often found in regular savings accounts. Typically, you must deposit a particular sum of money each month.

My money is safe – Best Savings Accounts

It’s crucial to confirm that your funds are covered by the Financial Services Compensation Scheme before opening a savings account (FSCS). This is in place to safeguard savers and offer compensation if their preferred supplier stops doing business and is unable to repay their money.

In the event that a saver’s bank or building society fails, the FSCS serves as a “last resort” fund. Each UK-licensed financial services company is required to pay a levy to support it.

The FSCS provides protection for any provider that is licenced by the Prudential Regulation Authority and subject to Financial Conduct Authority regulation.

The amount of your deposits that is safeguarded by the FSCS is subject to a cap. Currently, this is set at £85,000 for each individual banking licence.

Joint account accounts would be covered up to a total of £170,000.

Keep that in mind if you have £85k in each of the two banks that make up the same organisation. If you have money in both Halifax and Bank of Scotland, both of which are owned by Lloyds Banking Group, you will be protected for £85,000.

Bonds for national savings

Another well-liked alternative is Premium Bonds from National Savings & Investment, which provide investors with the chance to win monthly cash rewards ranging from £25 to £1 million.

Premium Bonds have a minimum investment requirement of £25 and a maximum holding amount of £50,000. You would then have 50,000 chances to win in the monthly prize drawing.

The fund’s reward rate was raised from 1% to 1.40 per cent in June 2022. NS & I also provide other savings options. Its Direct Saver and Income Bonds’ interest rate climbed to 0.5 per cent in February from 0.35 per cent.

At the end of October 2021, the Treasury-backed bank NS & I also introduced Green Savings Bonds. Although you must commit your funds for three years, they now pay a rate of 1.3 per cent annually. The Green Savings Bond from NS & I are covered in more detail here.

All of the UK’s savings accounts are monitored by Savings Champion. It ranks the top five products in each category according to merit and does not take into account any business connections.