Gap insurance is a no-brainer, whether you have outstanding debt on an auto loan or are currently leasing your vehicle. In the event that you total your car, gap insurance can assist you in covering the difference between the real value of your car and the balance owed on your loan or lease.

Learn more about what does gap insurance cover and your alternatives with our guide before it’s too late. If the car is totaled or stolen, gap insurance assists in covering the loan balance. Even the greatest cars start to lose value as soon as you acquire them, so if you’re still making early car payments, chances are you owe more on the car than it is truly worth.

Is gap insurance worth it? Unfortunately, regardless of how much money you really owe on your loan, your insurance provider will only cover the current value of the vehicle if your car is declared a total loss as a result of a theft or serious accident. Of course, not all car purchasers have the time, energy, or desire to search online for the best price in order to save a few dollars.

To assist you in finding the top GAP insurance companies in the UK, The Car Expert has put together this helpful guide.

What Is Gap Insurance?

If you lease your car or finance your car with a loan, you may add gap insurance as a form of supplemental policy to your auto insurance policy. “GAP insurance” stands for “guaranteed auto protection,” and while it does protect your car, it also protects your finances in case of a serious accident.

Whether your car was stolen or totaled, gap insurance offers a payout that is regarded as the difference between the value of the car when you originally received it (the remaining amount of its lease or loan) and the value at the time of the occurrence. However, since not all carriers provide gap insurance, it could be challenging to get gap insurance via your current vehicle insurance provider. In actuality, several significant national insurers don’t, including State Farm, USAA, and Geico.

Top Gap Insurance Providers

Due to the low cost and simplicity of cancellation when no longer required, gap insurance offered by vehicle insurers is typically preferred by car buyers. Additionally, you can talk to your car insurance agent right away if you have any queries or problems. Here is a list of well-known insurers that provide gap insurance coverage if you’re financing or leasing a new car.

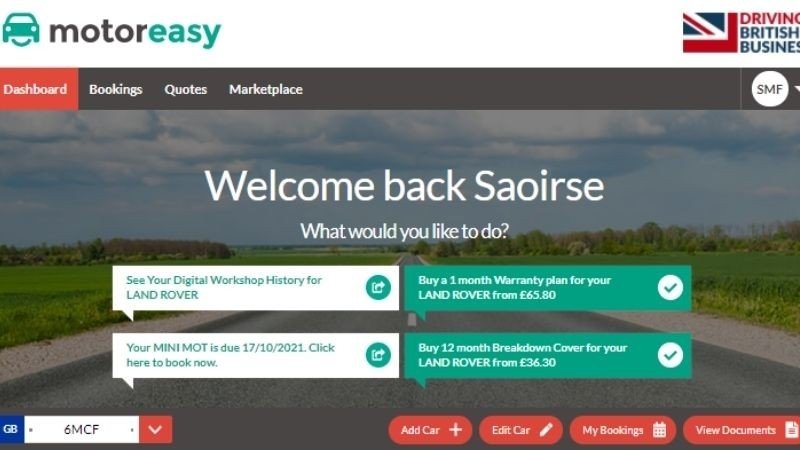

MotorEasy

MotorEasy strives to be a one-stop shop for all your automotive requirements, and GAP insurance is only one of the car services it provides to its clients. Additionally, it accommodates commercial trucks as long as their weight does not exceed 3,500 kg. The service ratings for MotorEasy are “Excellent 4.7/5” on Trust Pilot, “Excellent 4.7/5” on eKomi, and “5 Stars” on Defaqto.

With the help of a very straightforward quotation tool on its website, MotorEasy has amassed a devoted following of clients. The policy has no transfer option, so your coverage will terminate if you sell the car. There is an overall mileage cap of 100,000 that you should be aware of. If you decide to cancel after the first 30 days, you will get a pro-rata refund.

With the exception of Hawaii, Amica is another significant US insurer. New Englanders have reported having particularly excellent experiences with Amica’s service, and the carrier is well renowned for its high customer satisfaction ratings. The insurer offers flood, condo, life, house, and small business insurance in addition to car insurance products. Your bill will read “auto/loan leasing coverage” if you purchase gap insurance from Amica. Not every state offers this coverage.

GAP Direct

GAP Direct checks all the requirements while saving you the cost of dealer-purchased gap insurance, offering gap coverage comparable to what you may obtain elsewhere. With choices for 2-or 3-year coverage lengths, loans and leases can both be covered. There are also renewal terms available. Up to $25,000 of the outstanding loan debt is covered, starting at a fixed rate of $185. In the majority of states, GAP Direct will also pay your deductible up to $1,000. GAP Direct insurance is offered by Western General Insurance Company, a California-based insurer with almost 50 years of expertise.

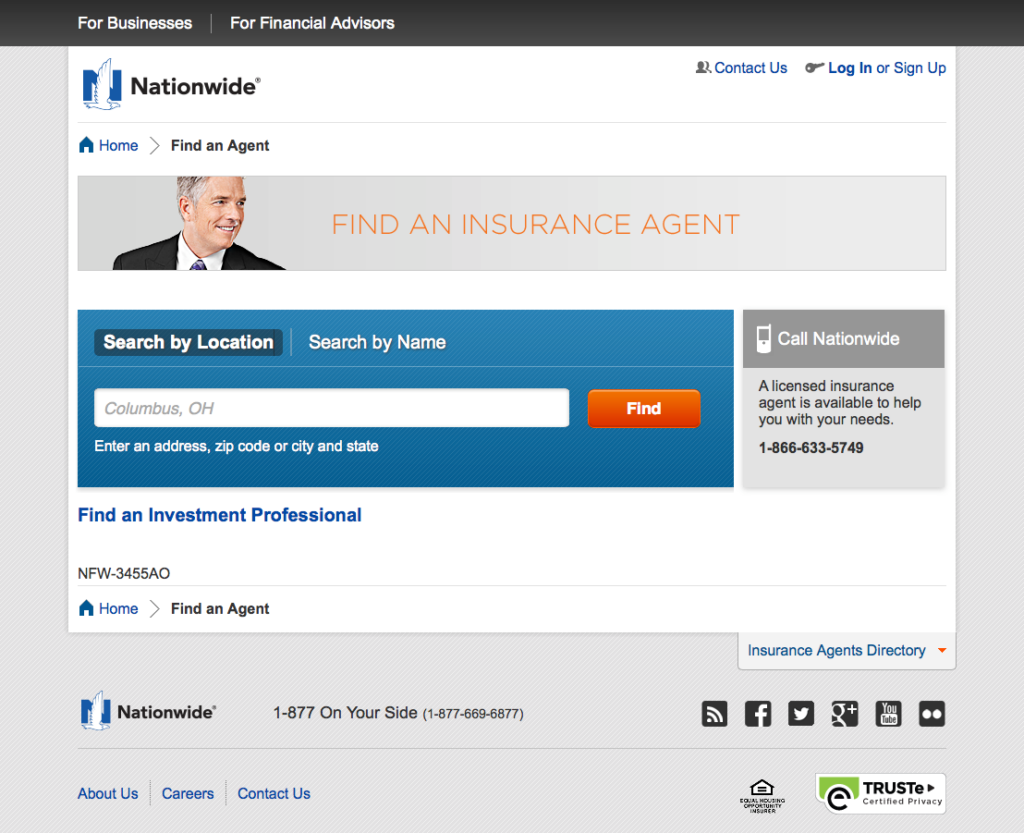

Nationwide

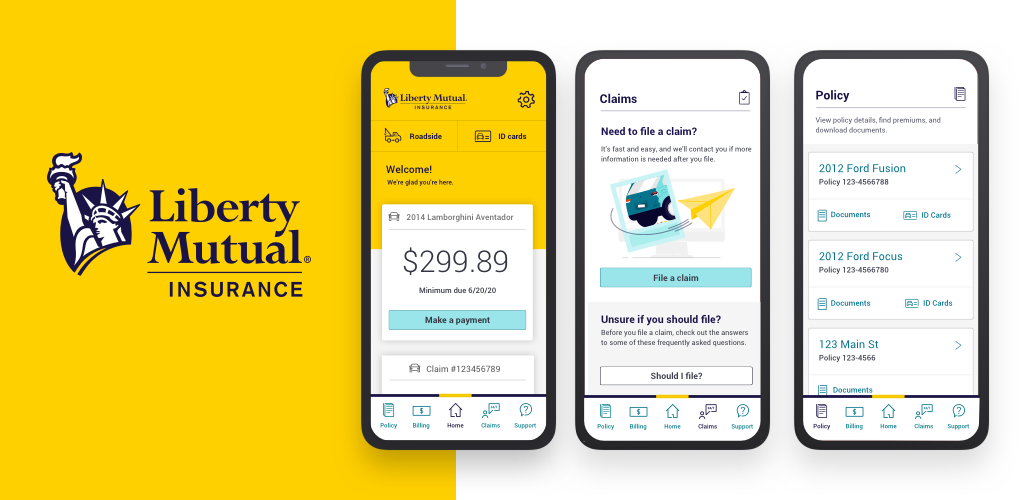

Another significant provider of gap insurance is Liberty Mutual, which has its main office in Boston, Massachusetts. Liberty Mutual’s gap coverage is among the most widely available in the nation because the company provides auto, home, and life insurance plans in all 50 states plus Washington, D.C. Because of this, the carrier always gets a lot of complaints sent to the National Association of Insurance Commissioners on a national level, and it always gets below-average ratings in customer satisfaction surveys by J.D. Power.

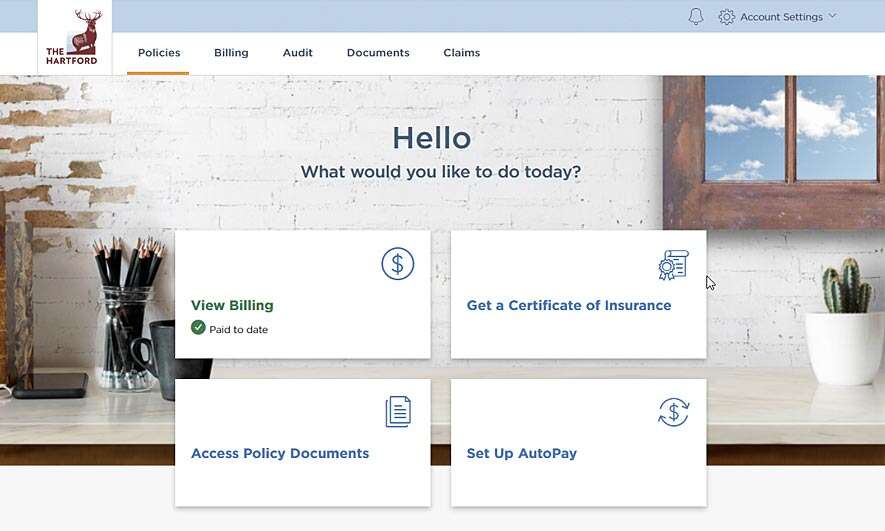

Gap insurance is included in the list of car insurance options provided by The Hartford. But not all drivers should use this carrier. The Hartford’s motor insurance policy is designed for people over 50 who are American Association of Retired Persons members. In addition to insurance, Hartford also provides car replacement coverage, which, in the event that your car is totaled, will pay for a new car of the same make and model as yours rather than pay out the depreciated value of your car.

Does Anyone Need Gap Insurance?

There are various situations where customers might benefit from gap insurance, even if it is not required by law and may be requested by lenders. If your down payment is 20% or less or your loan duration is more than 4 years, several insurance providers advise purchasing this. In each of these scenarios, the loan sum might, in the initial years of ownership, be greater than the car’s worth in a complete loss insurance claim.

Here is one instance:

- You may anticipate the depreciation of a $35,000 new car to be roughly 20% on average. In the first year, that amounts to $7,000. After the first year, the rate of depreciation usually slows down to about 10% of the car’s original value per year.

- It usually takes a little longer for the loan balance to decrease. After a year, you’ll still owe close to $30,000 if you took out a 72-month loan at 5 percent interest and put down enough money to cover taxes and tags.

- In contrast, your insurer would probably pay roughly $27,000 in a complete loss insurance claim because of depreciation. The claim payout is reduced to $26,000 if you have a $1,000 deductible, leaving a $4,000 gap that you would have to fill out of pocket.